Everybody loves talking about mortgages. They’re fun, easy to understand, and a great icebreaker, right?….Wrong. Thanks to their lengthy process, technical jargon, and confusing options, mortgages have a bit of an intimidating reputation—but it doesn’t have to be that way!

If you’re in the process of buying a new home and dreading the mortgage application process, here’s what you need to know to keep things running smoothly.

Know How Much You Can Spend

If you’re feeling antsy about getting started and want a general idea of how much loan you might qualify for, consider the 28/36 rule, or the Debt-to-Income ratio—AKA what most lenders use to help calculate your mortgage.

Essentially, the 28/36 rule means that your monthly mortgage payment shouldn’t be more than 28% of your gross income. Additionally, your outstanding debts—like mortgage, car loans, student loans—shouldn’t account for more than 36% of your gross income.

Get Your Finances in Order

Not seeing the numbers you were hoping for after calculating your Debt-to-Income ratio? Then, hopefully, you’ve given yourself a little time to shift things in your favor. Paying off loans, improving your credit score, avoiding big purchases—these will all help you change those numbers.

Of course, completing those tasks is a little harder to do in practice than in theory, so you may have to take a look at your budget and see where you can cut out some extras—at least temporarily!

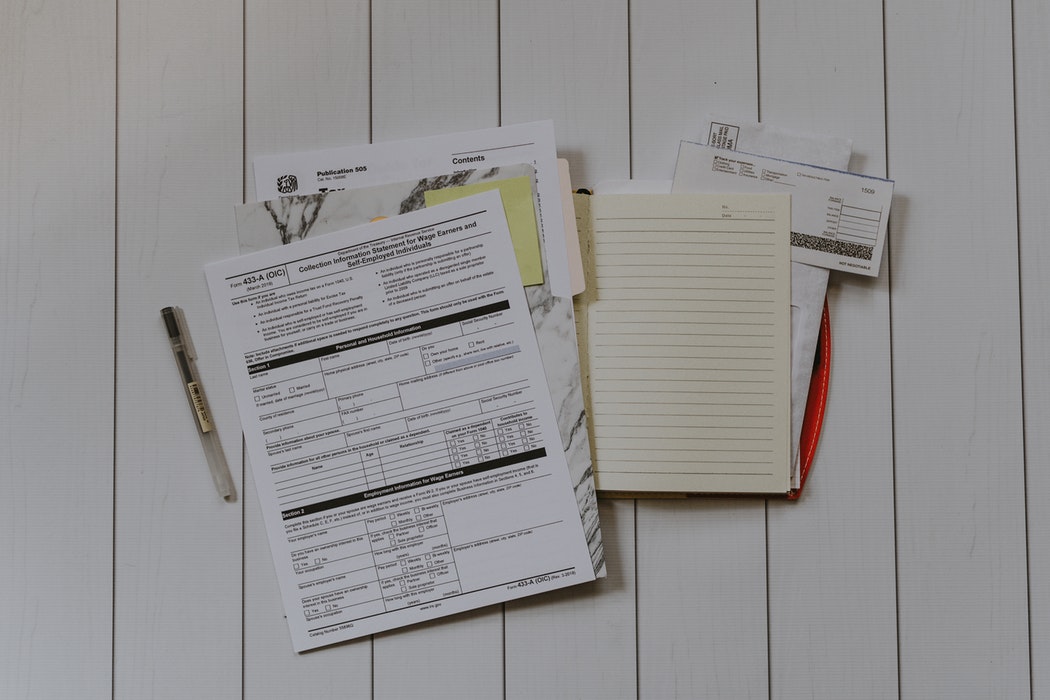

What You’ll Need to Apply

In the weeks before you plan on applying for a mortgage, you should start collecting all of the documents you need. Since a lender will be telling you exactly how much money they’re willing to loan, they’ll need a comprehensive understanding of your finances beforehand. Start gathering things like:

- W2s/tax returns

- Photo ID

- Your two most recent pay stubs

- Current and prior addresses

- Asset information (retirement funds, 401(k), stocks and bonds, other investments)

- Gift letters

Depending on the lender you choose, you may need additional documents, so consider calling in to double-check beforehand.

Find the Right Mortgage

Once it’s time to start thinking more concretely about applying for a mortgage, you have several options to consider. While all the mortgage options out there could easily fill a whole blog post on their own, here’s a quick rundown to give you a general idea:

- Conventional/Fixed-rate: The interest rate of a fixed-rate loan won’t change over time, making it a popular choice for its predictability. Conventional loans typically require a 20% down payment or mortgage insurance for smaller down payments.

- Adjustable-rate: The interest rate of adjustable-rate mortgage will fluctuate over time, sometimes lower than fixed-rate, sometimes higher. There is a cap in place so the rate doesn’t get too out of control, but ARMs are typically more popular with those who plan to refinance.

- FHA: If you are struggling to come up with a down payment, you may have options with an FHA mortgage. Provided by the Federal Housing Administration, these loans come with a low down payment requirement and built-in mortgage insurance.

- USDA: Live in a rural area? Then check out your USDA eligibility! A surprising amount of areas qualify for USDA loans, even if you aren’t living in the countryside. Plus, USDA loans don’t require a down payment and offer lower insurance premiums.

These aren’t the only options you’ll have, just the most common. If none of these sound right or you aren’t sure which to choose, just ask your lender!

Choose the Right Lender

When it comes time to decide who to work with, you’ll have to do your research. Each lender is different, meaning they’ll likely offer you different rates, charges, and loan options.

Luckily, we’ve been working in real estate around the area for years, so we know exactly which lenders are right for which buyers. If you need a few suggestions before you kick off your search, just let us know!

Still Have Questions?

That’s okay—we get it. Applying for mortgage is confusing and challenging, especially if it’s your first time. If you have any questions about the process, we’re here to help.

Ready to start looking at a few homes in your price range? We can help with that, too! Check out our specialized search tool to narrow down your options, and give us a call to start seeing a few in person!