If you’re considering listing your home, information on your home’s value is absolutely your most valuable resource. Many people start with Zillow to ballpark a listing price, but a Zestimate isn’t the last word in accuracy and it shouldn’t be the last stop on your valuation journey. Without question, research into the right listing price for your property should incorporate multiple data points. An in-depth valuation platform and the assessment of an experience realtor are two of the most valuable insights into how profitable the sale of your home may be. It may surprise you — and it could cost you if you’re relying on outdated or incorrect information.

Zillow Uses Generalized Data, Not Local Expertise

Zillow pulls from publicly available data like tax records, past sales, and regional trends. While this information can offer a rough estimate, it doesn’t account for the specifics of your home—like a recent kitchen remodel, a new roof, or that stunning backyard oasis you added last spring. These custom upgrades can significantly change your home’s value, but Zillow’s algorithm simply isn’t equipped to capture them.

Local real estate agents, on the other hand, know what features buyers in your specific neighborhood care about most. A pool might add major value in one area but be considered a liability in another. Without boots-on-the-ground knowledge, Zestimate calculations can miss the mark by tens of thousands of dollars—sometimes more.

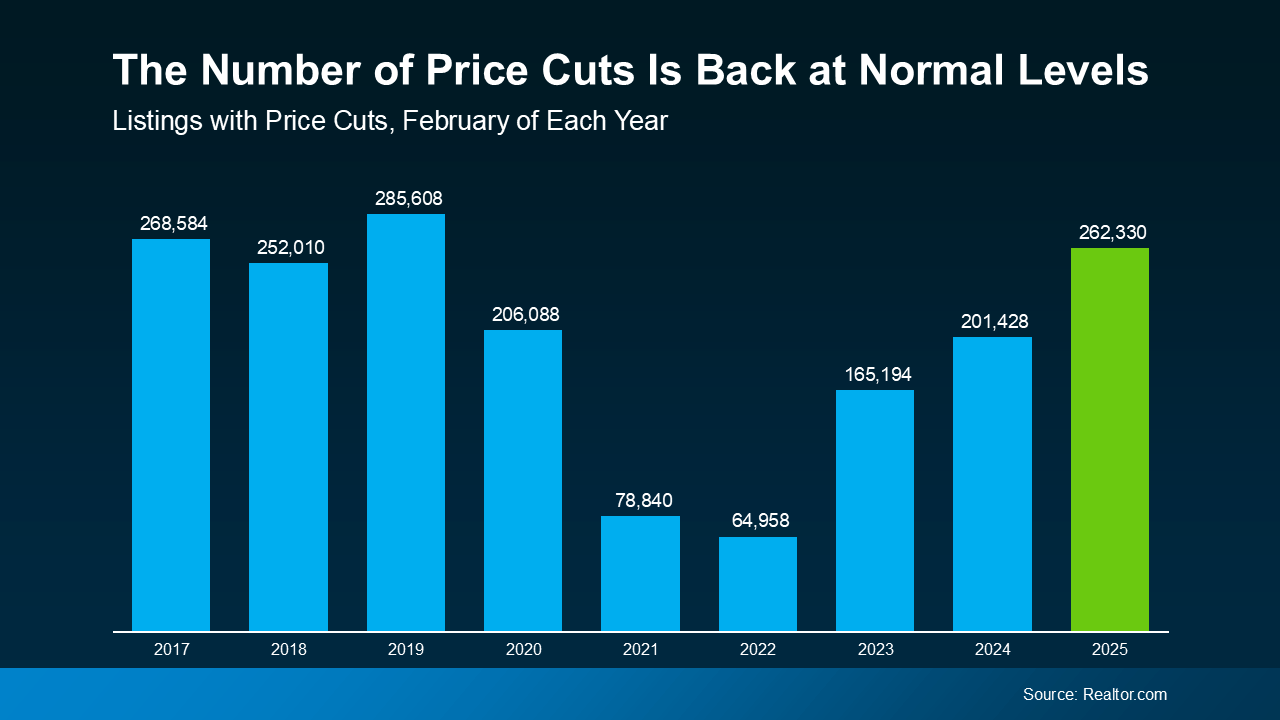

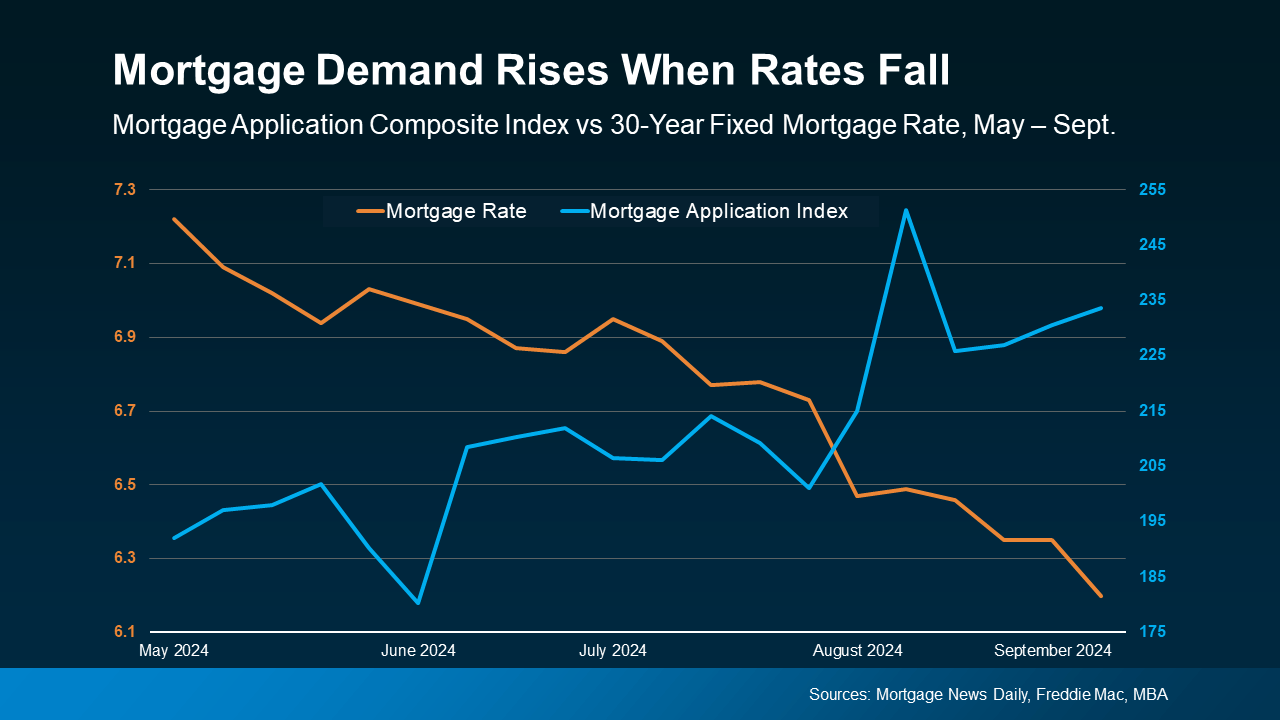

Market Conditions Shift Faster Than Algorithms Can Adapt

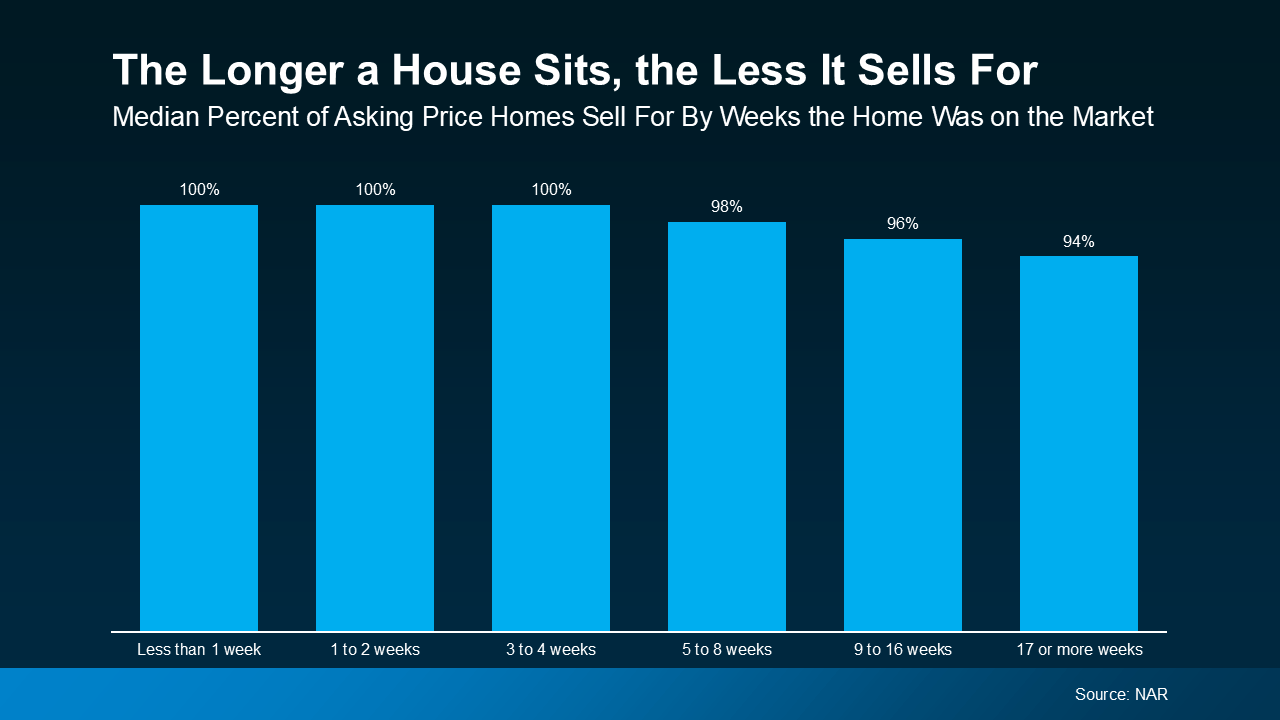

The real estate market can change rapidly due to interest rate fluctuations, inventory levels, or local economic factors. Zillow’s Zestimates are updated regularly, but they still lag behind real-time market dynamics. If your area has seen a recent surge in buyer demand or a new school rezoning, those changes might not be reflected in Zillow’s estimate.

Conversely, if your neighborhood is cooling off or facing an uptick in foreclosures, Zillow may still show outdated pricing based on older comparables. A professional CMA (Comparative Market Analysis) from a local agent can give you a snapshot of current market value based on listings and recent closings in your area—something a nationwide algorithm simply can’t do with accuracy.

Zillow Doesn’t See Your Home’s Condition or Story

Your Zestimate is generated by an algorithm that has never stepped foot inside your home. It doesn’t know if your property has been lovingly maintained or if it needs major repairs. Two identical floor plans on the same street could vary in value by thousands, depending on updates, layout flow, curb appeal, and even scent—factors only a real human can assess.

Buyers don’t just buy a square footage number—they respond to feeling, flow, and emotional connection. Zillow can’t capture that. That’s why partnering with a trusted real estate professional who can tour your home, consider its unique qualities, and analyze current buyer behavior is the best way to price your home accurately and profitably.

Bottom Line: Zillow is a great starting point, but not a reliable source for making big decisions. If you’re curious about your home’s true market value, don’t rely on algorithms—lean on local expertise.

Want to make sure your home sells quickly and for the best price? Let’s go over the right pricing strategy for your house.

Find out what your home is really worth in today’s market: https://www.accentrealtors.com/tulsa-home-value

To read more about the benefits of an accurate home valuation, check out our article on The Secret to Pricing Your Home Right in a Shifting Market.