Key Facts

- Learn the critical role of mortgage preapproval for first-time homebuyers.

- Understand the benefits of comparing mortgage rates and maintaining a healthy credit score.

- Discover how real estate agents and home inspections contribute to smart, secure investments.

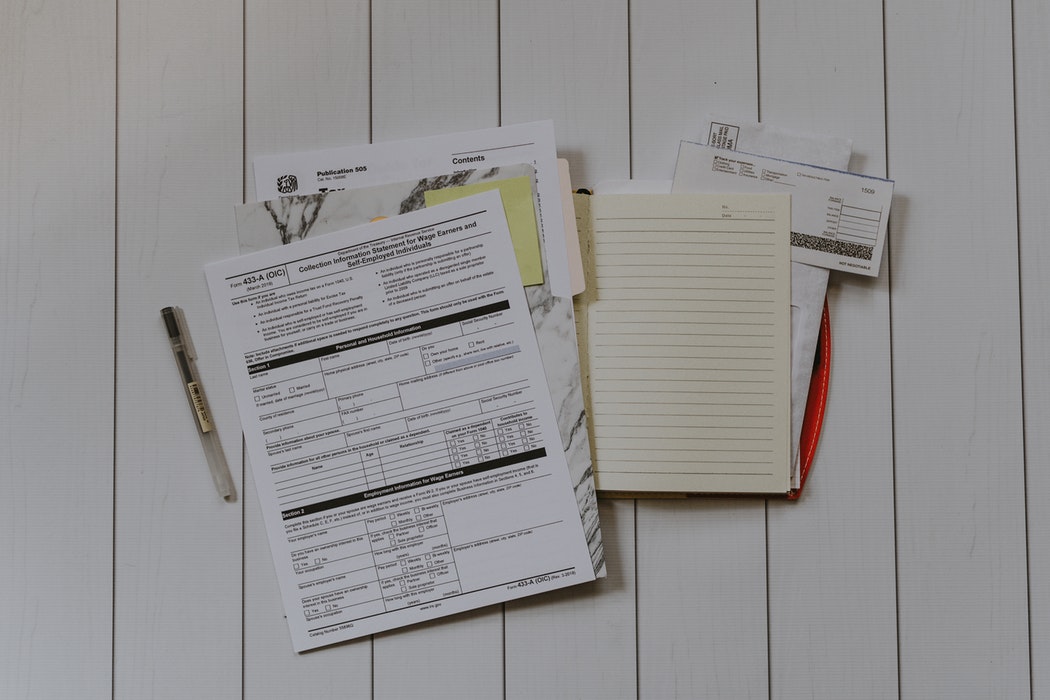

Stepping into homeownership is an exciting adventure, but it can also be filled with uncertainties, especially for first-time homebuyers. It’s easy to feel a mix of joy and nervousness as you make one of the biggest purchases of your life. Continue reading to discover common pitfalls and gain expert advice to help you navigate the homebuying process with confidence and ease.

1. Not Starting the Approval Process Early

Begin your house hunting with a solid foundation by securing mortgage preapproval early on. This proactive step not only clarifies your budget but also strengthens your position in competitive markets, showing sellers you are a serious and prepared buyer.

2. Settling for the First Mortgage Offer

Don’t rush to accept the first mortgage offer you receive as a first-time homebuyer. Taking the time to compare various lenders can lead to better interest rates and loan terms, potentially saving you a significant amount of money over the life of your loan.

3. Buying Without a Real Estate Agent

While it might be tempting to go at it alone, partnering with a real estate agent can transform your homebuying experience. Agents bring invaluable expertise in negotiation and a deep understanding of local market conditions, facilitating a smoother and more successful transaction.

4. Underestimating Your Budget Needs

It’s crucial to balance your aspirations with a realistic budget. Look beyond the mortgage payments to include all potential living costs, such as utilities, maintenance, and lifestyle expenses. Avoid exhausting your savings on upfront costs—maintain a reserve for unforeseen expenses.

5. Neglecting Credit Score Monitoring

Keep a vigilant eye on your credit score throughout the homebuying process, especially as a first-time homebuyer. Lenders will reassess your credit before finalizing your loan, so it’s important to avoid any major purchases that might negatively impact your credit status.

6. Waiving the Home Inspection

Foregoing a home inspection might seem like a shortcut to ownership, but it can lead to unexpected complications and expenses. Inspections are crucial for uncovering potential issues that could give you leverage in negotiations or save you from future costs.

7. Ignoring First-Time Buyer Programs

Many first-time buyers may not be aware of the various assistance programs available to them. These programs can provide significant help with down payments and closing costs, lightening your financial load.

8. Overlooking Your Lifestyle Preferences

Your life won’t just unfold within the walls of your new home; you’ll also be living in the surrounding area. Take the time to explore local amenities, cultural events, and the overall atmosphere to make sure it aligns with your lifestyle preferences.

9. Making Decisions Based on Emotion

Buying a home is an emotional journey. It’s essential to feel connected to a property, but it’s also important to remain practical. Your real estate agent is there to guide you through this process, helping you balance emotion with critical considerations of your long-term needs and financial plans.

Start Your Successful Homebuying Journey Today

With the right approach and knowledgeable guidance, as a first-time homebuyer, you can avoid common pitfalls and make informed decisions in your homebuying journey. Utilize the expertise of your real estate agent, who is there to support you every step of the way, ensuring you find and secure a home that meets your needs and your budget. Contact us today to learn more about how we can assist you in confidently navigating your path to homeownership.

To learn more, read our article on First-Time Home Ownership.

The post 9 Mistakes Every First-Time Homebuyer Should Avoid: Secure Your Dream Home with Confidence appeared first on Dakno Blog.